City of Industry Bankruptcy Attorney

City of Industry businesses and debtors who file for bankruptcy typically do so because debt has become overwhelming or they risk loss of funds and other assets from seizures or repossessions. Even individuals who control their spending cannot escape incurring significant debt when an unexpected event such as an illness, accident or loss of work disrupts their lives.

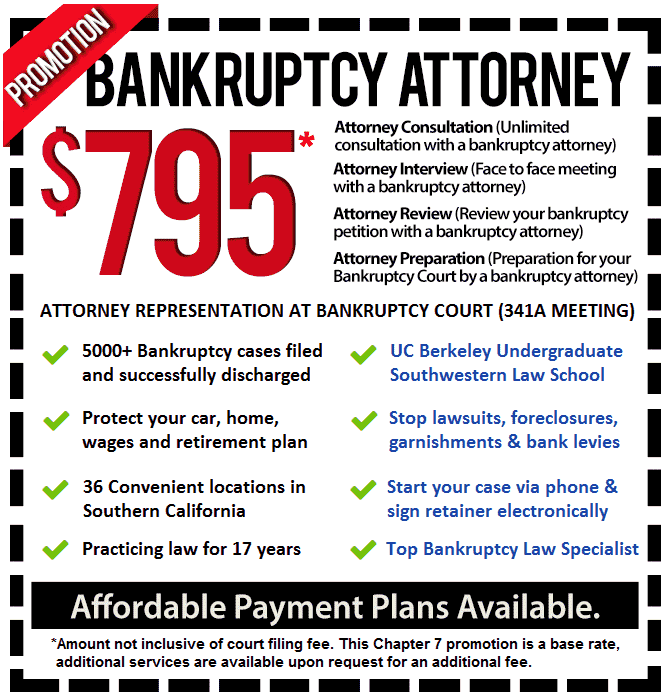

For information on how bankruptcy can help relieve you of debt problems and save your assets, call a City of Industry bankruptcy attorney at (888) 754-9877.

Bankruptcy can wipe out certain debts and allow you to keep your assets or repay creditors over time. A City of Industry bankruptcy attorney has to confirm your eligibility to file. Businesses can dissolve their operations or continue operating and also repay creditors over time with the assistance of a City of Industry bankruptcy attorney.

A City of Industry bankruptcy attorney can handle bankruptcy for individuals and businesses.

Chapter 7 Bankruptcy

Eligible City of Industry debtors, as verified by a Chapter 7 Bankruptcy Lawyer, can have certain debt wiped out such as credit card charges, department store bills, medical bills, payday loans, personal loans and deficiency judgments. A business that wants to wind up operations can discharge the business debt by selling its assets to pay creditors to some extent.

A Chapter 7 Bankruptcy Lawyer will also match personal assets to available exemptions. Individual filers have to complete certain debt education classes before and after filing that a Chapter 7 Bankruptcy Lawyer will arrange. A debtor’s only appearance will be before a trustee to review the filed petition of financial affairs. Your Chapter 7 Bankruptcy Lawyer will be with you at the meeting.

Chapter 13 Bankruptcy

A Chapter 13 Bankruptcy Attorney may advise you that only Chapter 13 is available based on your ineligibility or because you risk loss of non-exempt assets. Under this proceeding, individuals or City of Industry sole proprietors who personally guaranteed any business debt will have a Chapter 13 Bankruptcy Attorney submit a repayment plan. The plan includes all liabilities as well as arrearages for a mortgage, auto, student loan or support payments. A Chapter 13 Bankruptcy Attorney can also adjust certain secured debt under the plan.

Debtors make a single monthly payment to a trustee for distribution. A Chapter 13 Bankruptcy Attorney will also see that any unsecured debt that would not have been paid under Chapter 7 is discharged.

Chapter 11 Bankruptcy

City of Industry businesses that are struggling but feel they can be viable can seek Chapter 11 protection with the help of an experienced City of Industry bankruptcy lawyer. A Chapter 11 Bankruptcy Lawyer files a disclosure statement for the creditors’ benefit and a reorganization plan that includes how debt will be restructured and how the business hopes to reorganize its operations.

The plan has to be confirmed by certain creditors. Once confirmed, the company as the debtor can continue to operate as before but any major business decisions to downsize, upgrade operations, re-enter into new contracts or leases or make major purchases have to be court-approved.

A Chapter 11 Bankruptcy Lawyer files the necessary reports and ensures the business complies with other formalities. If a small business or individual wants to file, they should consult with a City of Industry bankruptcy lawyer about its implications.

Call a City of Industry bankruptcy lawyer at (888) 754-9877 about how bankruptcy can relieve you or your business of burdensome debt and financial pressures.